The Definitive Guide to Bankruptcy Bill

Table of ContentsThe Single Strategy To Use For Bankruptcy InformationSome Of Bankruptcy CourtBankruptcy Business for BeginnersWhat Does Bankruptcy Australia Mean?The Main Principles Of Bankruptcy How Bankruptcy Business can Save You Time, Stress, and Money.

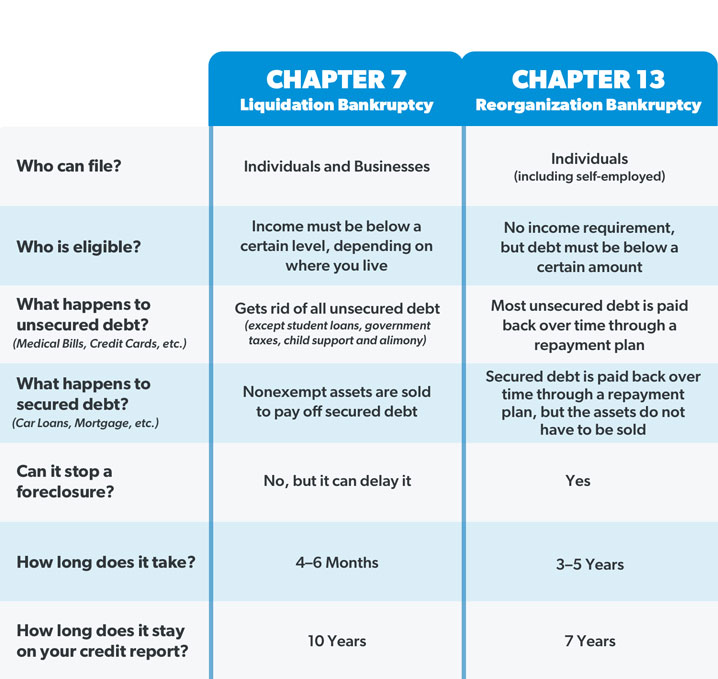

Chapter 13 is typically preferable to chapter 7 since it enables the debtor to maintain an useful possession, such as a house and also permits the borrower to recommend a "strategy" to pay off financial institutions in time normally 3-5 years. Chapter 13 is also utilized by customer debtors who do not get approved for phase 7 relief under the methods test.Chapter 13 is extremely different from chapter 7 since the chapter 13 borrower typically remains in ownership of the property of the estate and also makes settlements to lenders, with the trustee, based on the borrower's expected earnings over the life of the strategy. Unlike chapter 7, the borrower does not receive an immediate discharge of debts.

This publication reviews the applicability of Phase 15 where a borrower or its property goes through the regulations of the United States and also one or even more international nations. To read more concerning submitting insolvency, get in touch with our workplaces today. Our knowledgeable group can assist you obtain a financial debt free fresh begin.

Personal bankruptcy Regulation in the United States is Federal Legislation under Title 11 of the United States Code. Those are actual phases "in the book" of the Personal bankruptcy Code, and also each Phase pays for distinct arrangements.

The Basic Principles Of Bankruptcy Attorney

A Phase 7 personal bankruptcy is relevant to both companies and also individuals. In a corporate atmosphere, a Chapter 7 insolvency is a liquidation. In the most basic terms, the assets of the corporation are marketed to pay creditors pursuant to a priority system. In an individual Phase 7 bankruptcy, there is no liquidation of the person.

/GettyImages-184324155-1ae5c089b1c840c3a9070ac039027d78.jpg)

Most people that file Insolvency are enabled to maintain every one of their existing residential or commercial property and can obtain credit scores in the future. There is no minimum amount of debt required in order to be qualified to submit for Personal bankruptcy. All financial debt needs to be provided on a Personal bankruptcy request. There are lots of extra questions which we can answer for you during a consultation.

If you took a loan to acquire a lorry and also can not make your monthly repayments, your vehicle can be repossessed by the lending institution. A typical time frame to be worried regarding repossession would certainly be 45-75 days delinquency. There are several

The Main Principles Of Bankruptcy Attorney

Even if you have nondischargeable debt, insolvency might still be an alternative.

Your state provides the items bankruptcy filers can secure in its bankruptcy exception legislations, although some states let filers make use of the federal bankruptcy exceptions if they 'd protect extra residential property. (You need to choose one list or the otheryou can not make use of exceptions from both listings.) You'll utilize the very same exemptions in both Chapters 7 as well as 13.

, you 'd lose the nonexempt home, and also the trustee designated to handle your instance would certainly sell it and give the earnings to your lenders., you do not shed nonexempt property. Instead, you have to pay financial institutions what it's worth through the settlement plan.

You can maintain everything in Chapter 13, however it can be expensive. You need to pay your financial institutions the value of any kind of residential property you 'd shed in Phase 7. Generally, services don't file for Chapter 7 or 13. bankruptcy attorney near me. Instead, consider Chapter 11 or Chapter 11 subchapter V for local business.

Not known Facts About Bankruptcy Information

Receiving Chapter 13 isn't ever before simple, and also as a result of the various challenging regulations, you'll desire to deal with a bankruptcy legal representative. Until then, you can discover regarding the Phase 13 payment strategy and also get a concept about whether you make enough revenue to cover what you'll need to pay.

It's not best, however it will reveal you what you have to pay (you could need to pay more). Not long after you submit your "request" or bankruptcy documentation, calls, letters, wage garnishments, and also even collection lawsuits should come to a stop. It occurs since of the "automatic stay" order the court right away places in place.

At the conference, the trustee will inspect your recognition as well as ask inquiries regarding your declaring - bankruptcy bill. Lenders can show up and also ask concerns also, but they seldom do.

Generally, after one year you will certainly be released from bankruptcy and all of your financial obligations will certainly be created off. Personal bankruptcy deals with both protected and also unsafe debt.

The 10-Minute Rule for Bankruptcy Business

In some scenarios, the High Court can make you bankrupt at the demand of a financial institution. A financial institution can petition for bankruptcy versus you if you have devoted an act of insolvency within the previous 3 months.

As quickly as your bankruptcy starts, you are cost-free of financial debt. Your lenders can no longer look for repayment directly from you.

Anyone can inspect this register. Find out more in the ISI overview After you are made insolvent (pdf). The Authorities Assignee will certainly negotiate an Income Repayment Contract or look for a Revenue Settlement Order for the surplus of your income over the practical living expenses for your situation, based on the ISI's guidelines.

The Greatest Guide To Bankruptcy Bill

If you acquire properties after the date when you are made bankrupt (for instance, with inheritance) the Authorities Assignee can declare them and market them for the benefit of bankruptcy basics your financial institutions. If you have a family members residence, by yourself or with an additional individual, the Authorities Assignee may just sell it with the prior consent of the court.

If you hold property jointly (for instance, with your spouse) your insolvency will cause the joint possession to be divided between the Official Assignee and also your non-bankrupt co-owner. If the Official Assignee has actually not offered your residence within 3 years, ownership may immediately move back to you, unless or else agreed.